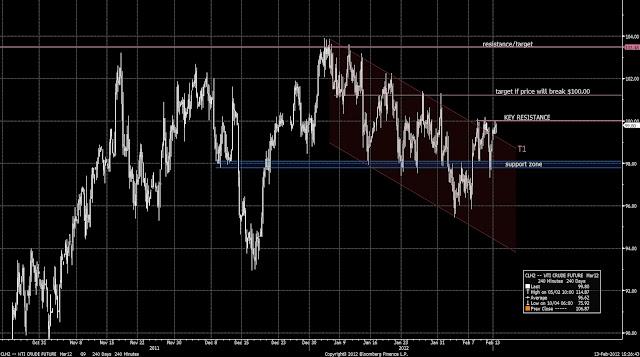

The Crude Oil (WTi) has tested the $100.00 resistance for 3 times in the last four sessions, putting some kind of bullish pressure on the market.

Although the Greek accord signed last night and IEA projections of lower demand have a bearish impact on crude prices, the bulls could be tempted if the price will break above the key resistance level of $100.00.

The mid-term outlook shows a down sloping channel started in early January which can turn out to be just a corrective move for the larger rising trend. If this will be the case, Crude Oil can hit $103.50 target in a matter of days but this move will have to be sustained by strong fundamentals.

The first target in case of a break above $100.00 level is the $101.20 area that marks previous highs and lows.

No comments:

Post a Comment